Managing finances as a startup can be overwhelming—but ignoring compliance deadlines comes at a high price. Here’s a breakdown of the most common accounting errors and what they can cost your business.

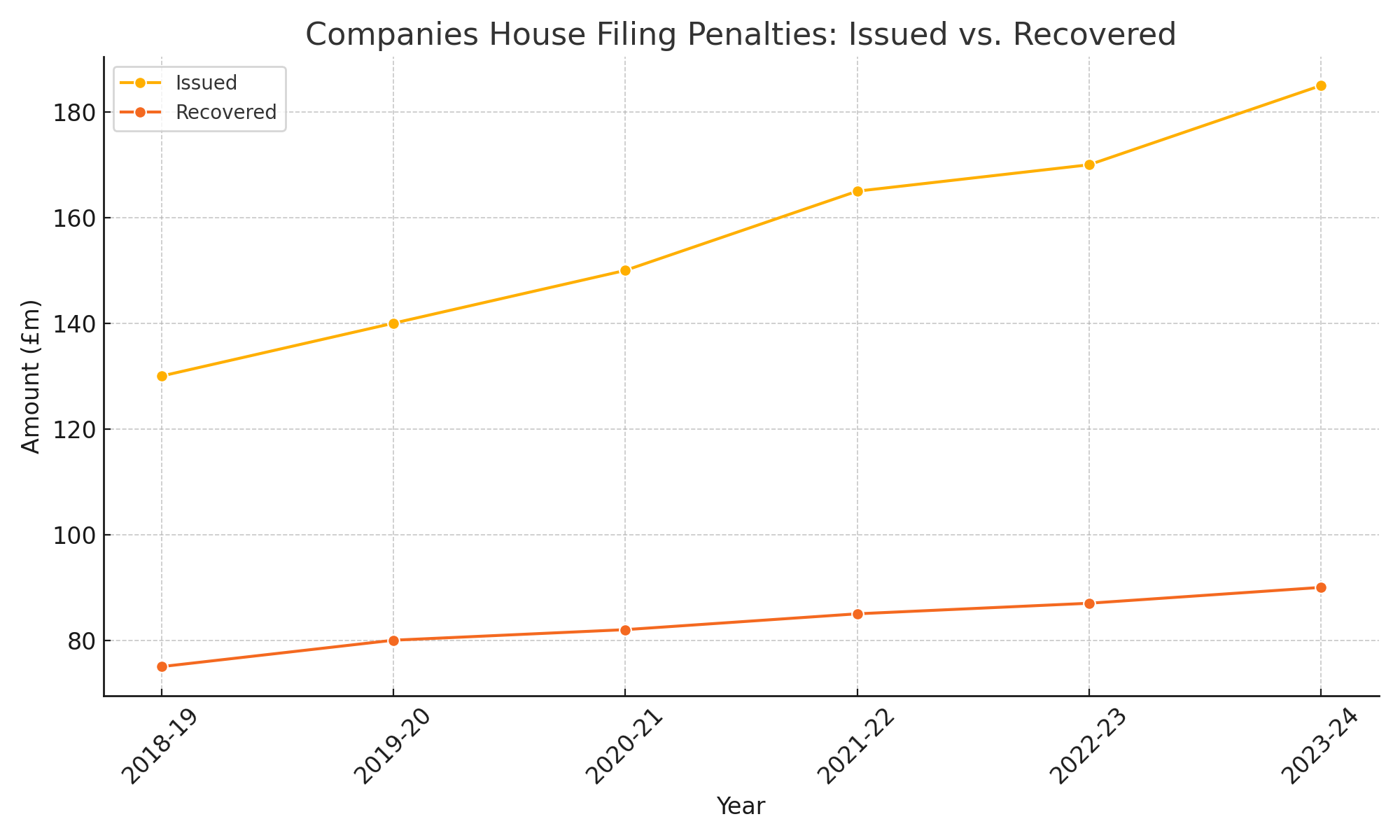

1. Late Filing of Accounts

Companies House penalties include:

- £150 if filed ≤1 month late

- £375 (1–3 months late)

- £750 (3–6 months late)

- £1,500 (over 6 months late)

In 2023–24, private companies faced approximately £34.4 million in fines for filings over six months late. Since 2018–19, over £785 million in penalties were issued, with less than half recovered.

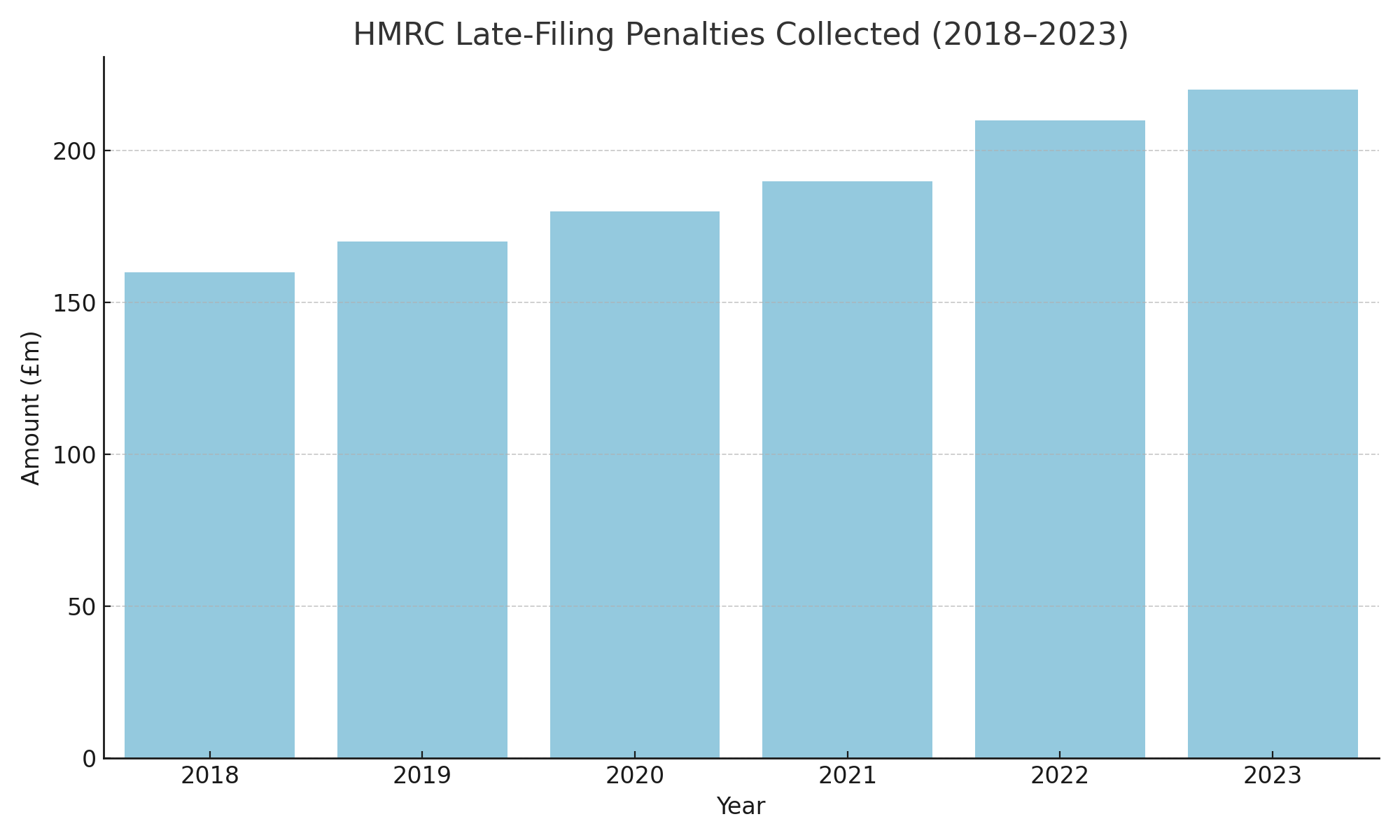

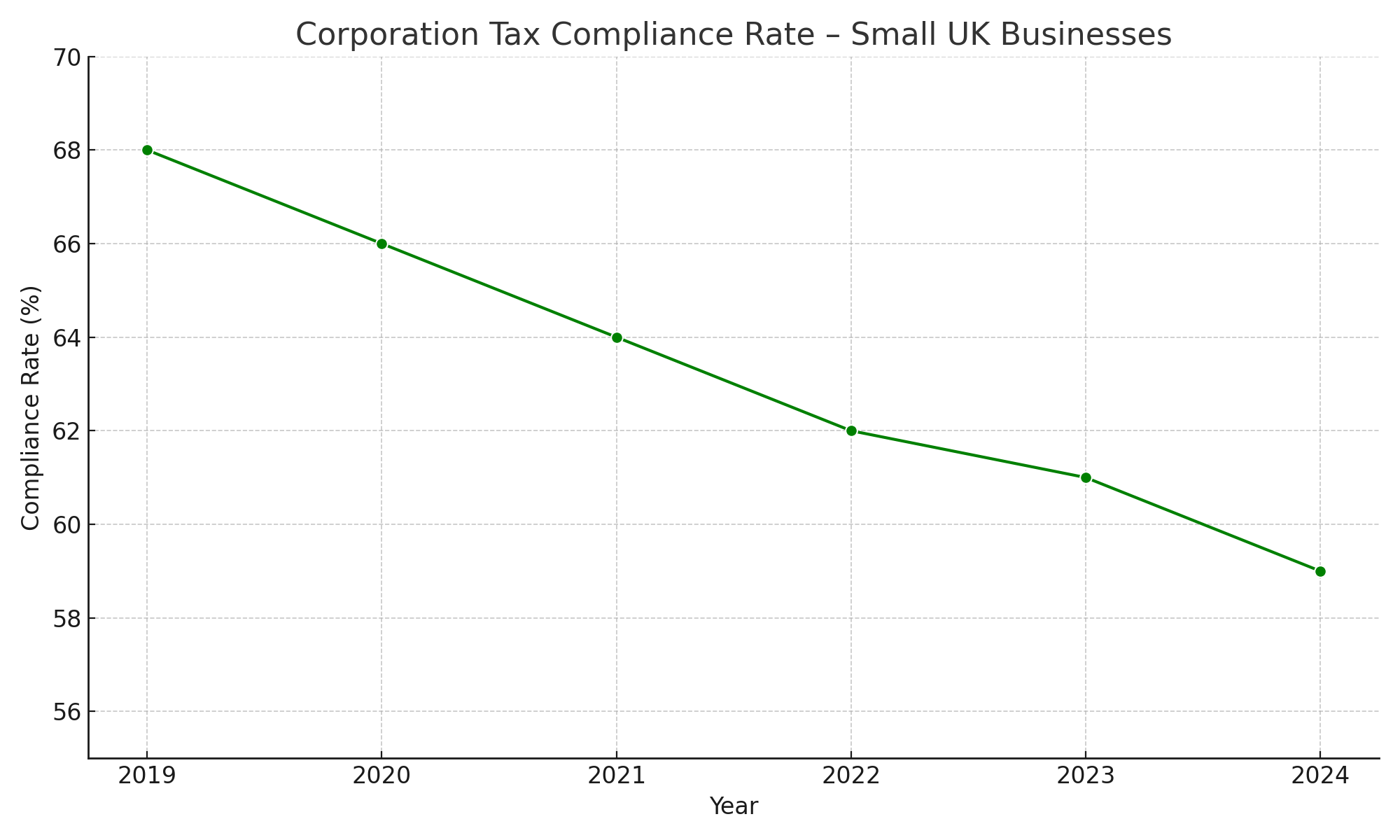

2. Late Submission of Self Assessment & Corporation Tax

HMRC penalties include:

- £100 fixed penalty (1 day late)

- Escalating fines after 3, 6, and 12 months

- Daily fines and surcharges

In 2022–23, HMRC collected £220 million in late filing penalties.

3. Accuracy Errors & Failure to Notify

Common issues include incorrect expense claims and not informing HMRC of changes. HMRC’s VAT penalty reform (2023) introduced a points-based system to penalise repeat offenders.

4. Poor Record-Keeping & Cash Flow Mismanagement

- Mixing business and personal expenses

- Ignoring PAYE for director salaries

- No budgeting or tracking cash flow

5. VAT Registration without Filing or Paying

Failing to submit or pay VAT leads to default surcharges, penalties, and investigations. VAT compliance is challenging without support.

📊 Snapshot of UK Compliance Penalties (2023–24)

| Issue | Penalty / Impact |

|---|---|

| Late Companies House filings | £34.4m in fines issued |

| Recovery rate on fines | 46% (~£73.5m of £158m) |

| HMRC late filing penalties | £220m collected |

| Unpaid Corporation Tax (SMEs) | 40.1% (£14.7bn of £36.7bn) |

| Low-income individuals fined | 83,000 cases (2021–22) |

⚠️ Real-World Example

An Etsy-based startup believed no profit meant no need to file. They missed tax deadlines and faced over £4,700 in fines—causing severe cash flow issues and reputational harm.

✅ How CG Incorporations Helps

Company Formation: Legal setup and deadline tracking

Accounting Services:

- Monthly bookkeeping

- Automated reminders for key deadlines

- Accurate PAYE & expense tracking

- Quarterly compliance reviews

Regulatory Compliance:

- On-time, accurate filings

- VAT management & penalty monitoring

- HMRC liaison services

❓ Frequently Asked Questions

HMRC: £100 fixed fines, daily penalties, and tax surcharges.

Published: 7/14/2025 9:20:25 AM. Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

For formal advice regarding UK company registration please…