Overview

Operating a UK limited company from overseas is increasingly common, but strict compliance with UK filing rules is required for all directors. This guide explains annual accounts, deadlines, penalties, and FAQs for non-resident company owners. CG Incorporations works with regulated UK accountants to keep you compliant from anywhere in the world.

Why Filing Annual Accounts Matters

- Legal requirement under the Companies Act 2006 and UK tax law

- Avoid penalties, company strike-off, or director disqualification

- Maintain good company standing and reputation

Key Filing Deadlines and Penalties

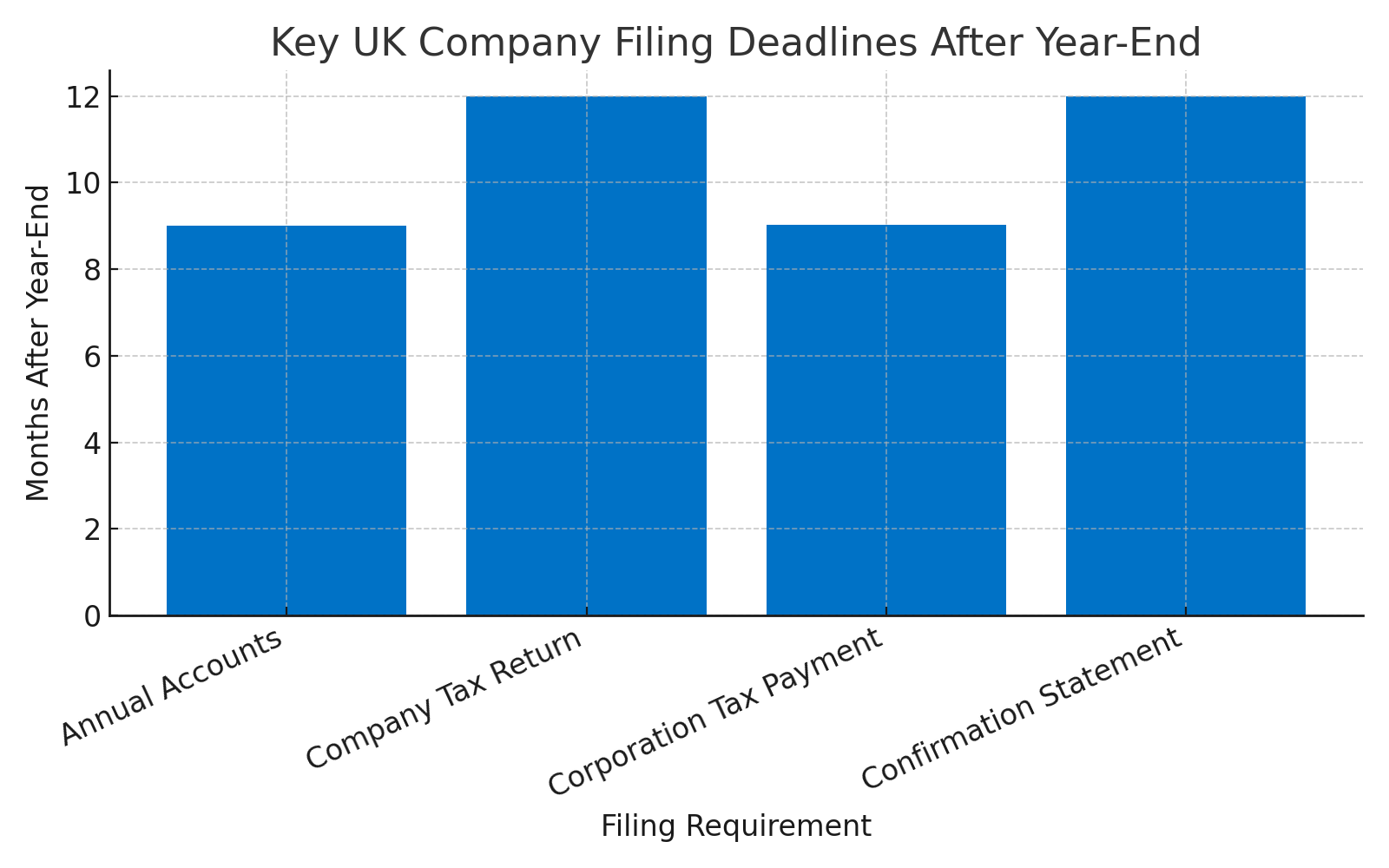

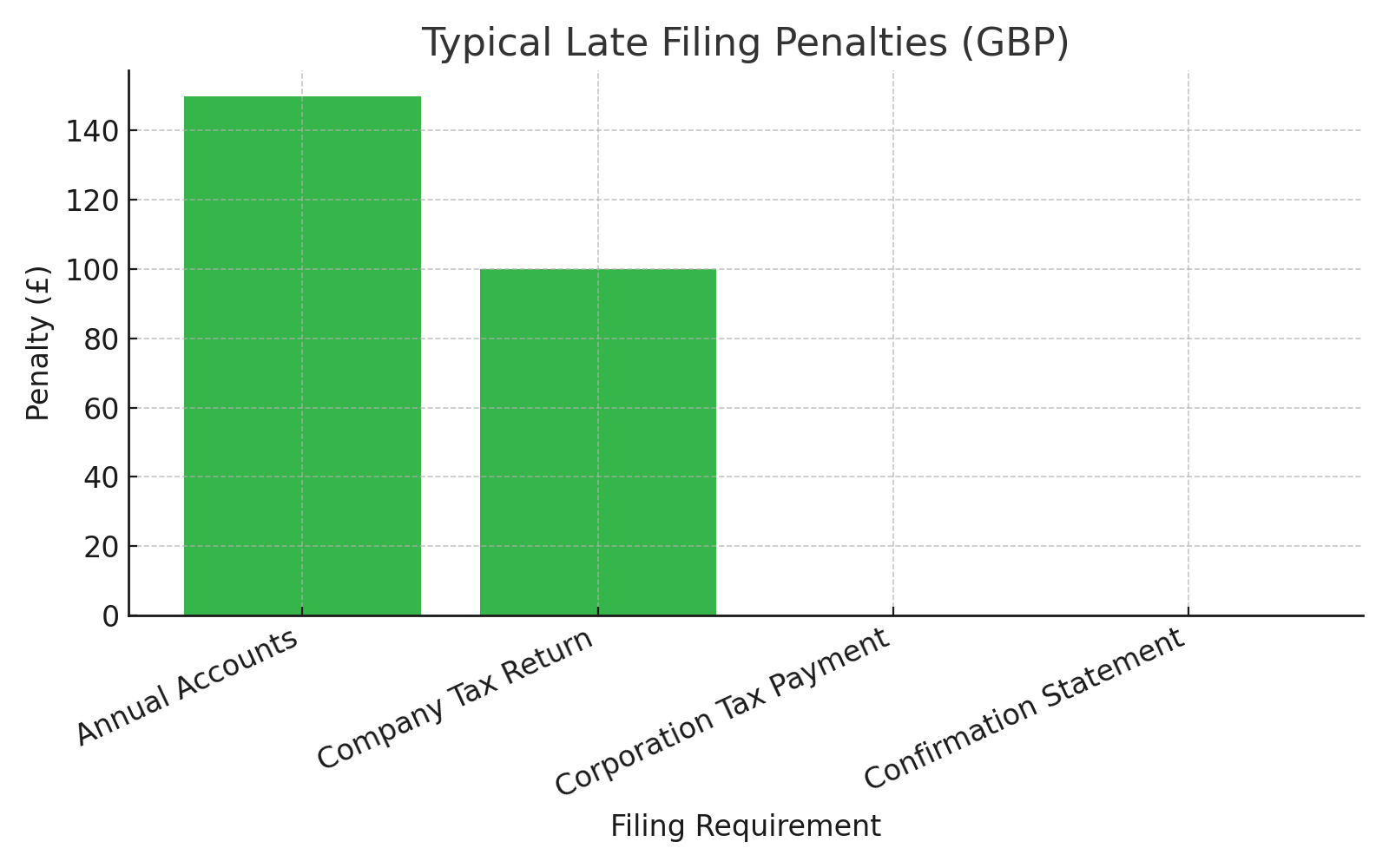

| Filing Requirement | Deadline | Who to File With | Automatic Penalty (Late Filing) |

|---|---|---|---|

| Annual Accounts | 9 months after year-end | Companies House | From £150 (up to £1,500 for long delays) |

| Company Tax Return (CT600) | 12 months after year-end | HMRC | £100 (increases if continued delay) |

| Corporation Tax Payment | 9 months + 1 day after year-end | HMRC | Interest charged |

| Confirmation Statement | Every 12 months | Companies House | Risk of company strike-off |

Filing Workflow for Overseas UK Company Owners

| Step | Action | Who Handles? | Notes |

|---|---|---|---|

| Record Keeping | Upload/send documents | Director/Bookkeeper | Use cloud software, email, or secure portal |

| Accounts Preparation | Prepare statutory accounts | UK-Registered Accountant | Accountant reviews all records |

| Director Approval | Review and approve filings | Company Director | Approval can be by email or e-signature |

| Filing | File with Companies House & HMRC | Accountant/Service | CG Incorporations arranges with registered agent |

| Deadline Monitoring | Reminders and compliance | Accountant/CG Incorporations | Automated reminders for deadlines |

Frequently Asked Questions

Why Choose CG Incorporations?

- Specialists in overseas client compliance

- Work with UK-registered accountants

- Registered office address services

- Remote onboarding and secure document sharing

Final Tips

- Plan ahead: Don’t leave filings to the last minute

- Keep digital records for ease and accuracy

- Update your accountant on changes

- Opt-in to deadline reminders

Disclaimer: This article provides general guidance only and is not legal or financial advice. Always consult a UK-qualified professional for your situation.

Published: 7/18/2025 10:42:01 AM. Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

For formal advice regarding UK company registration please…