Considering starting a company from abroad? Whether you're a global entrepreneur, digital nomad, or overseas investor, choosing the right jurisdiction is essential. The United Kingdom and the European Union (EU) both offer robust business environments—but which is better for non-residents?

This article explores the key differences in company formation requirements between the UK and EU jurisdictions, helping non-UK residents make informed decisions.

Why Consider the UK for Business Formation?

At CG Incorporations, we specialise in UK company formation for non-residents. The UK remains a top destination due to:

- Simple, fast online registration

- No requirement to visit the UK

- Low corporate tax rate

- No minimum capital for a private limited company

- Reputation for regulatory transparency and legal protection

UK vs EU Company Formation – Verified Comparison Table (2025)

| Feature | United Kingdom 🇬🇧 | Germany 🇩🇪 | Netherlands 🇳🇱 | France 🇫🇷 | Ireland 🇮🇪 |

|---|---|---|---|---|---|

| Company Formation Time | ≤ 24 hours (often same day) | ~10–20 business days | ~5–10 business days | ~7–14 business days | ~3–5 business days |

| Non-Resident Eligibility | ✅ Fully allowed | ✅ Allowed, more formalities | ✅ Allowed | ✅ Allowed | ✅ Allowed |

| Physical Presence Required | ❌ No | ✅ Often required | ❌ No | ✅ Often required | ❌ No |

| Minimum Share Capital | £1 (no minimum) | €25,000 (€12,500 paid) | €0.01 (BV) | €1 (SAS/SARL) | No minimum (1 share) |

| Corporate Tax Rate (2025) | 25% | ~30% | 25.8% | ~25–26% | 12.5% (trading income) |

| Annual Filing Requirements | Accounts + Confirmation Statement | Full Accounts + Tax Return | Annual Report + Local Filings | Tax + Social + Audit (if applicable) | Annual Return + Accounts |

| Language of Registration | English | German | Dutch or English | French | English |

| Ease of Remote Formation | ✅ Very Easy | ❌ More Complex | ✅ Moderate | ❌ Complex | ✅ Easy |

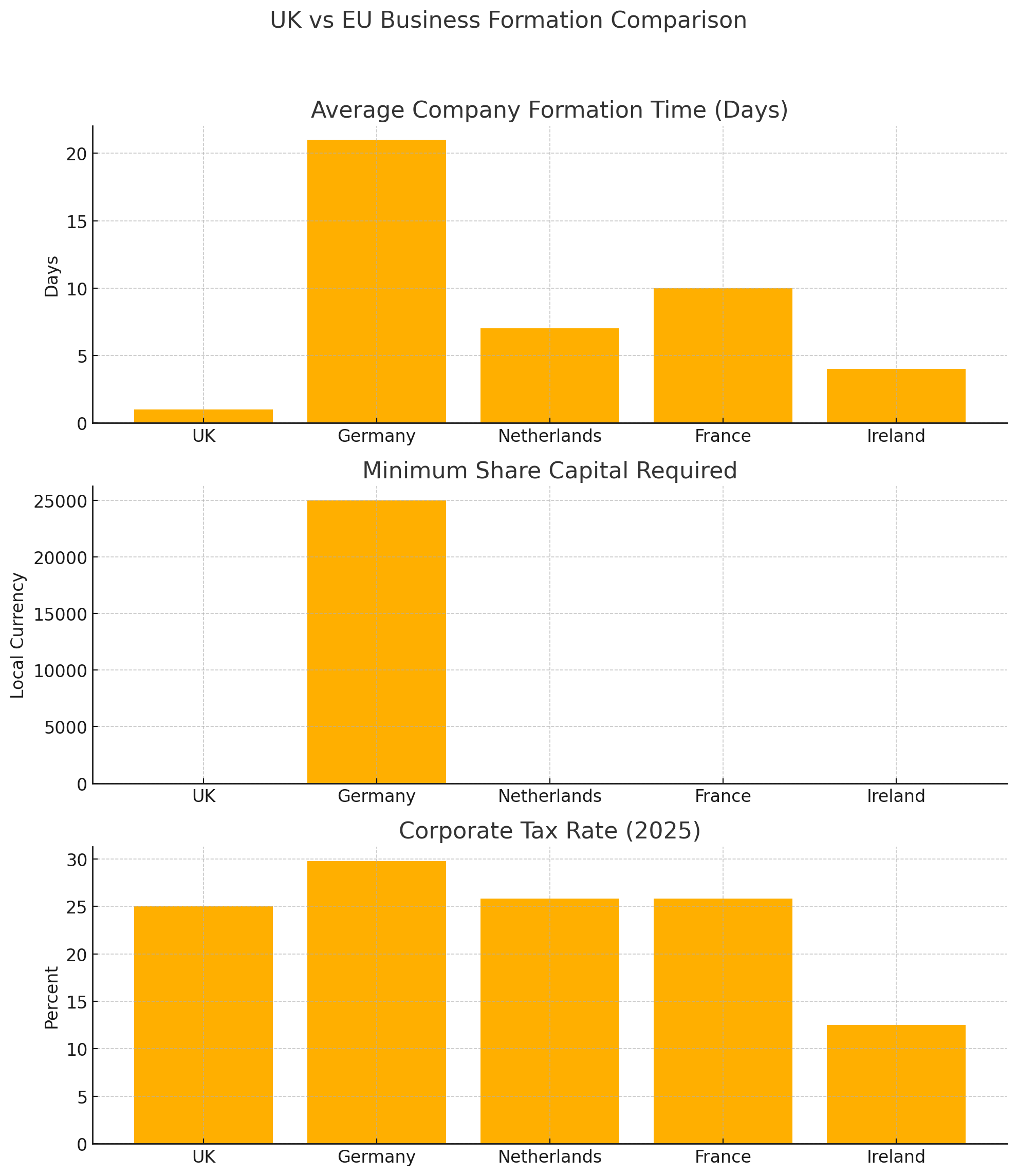

To better illustrate the advantages of forming a UK company as a non-resident, the graph below compares key metrics across five jurisdictions: the UK, Germany, Netherlands, France, and Ireland.

Key Metrics Compared:

- Company Formation Time (in days)

- Minimum Share Capital Requirements

- Corporate Tax Rate (2025 estimates)

These visual benchmarks reinforce why the UK remains a highly competitive and efficient jurisdiction for international entrepreneurs.

Key Benefits of UK Company Formation for Non-Residents

- Fast and affordable setup – no need for in-person visits.

- No minimum capital – unlike Germany or France.

- Remote-friendly – no local director or address needed beyond a registered office.

Incorporation Services for Non-UK Residents

CG Incorporations offers:

- Company registration with Companies House

- UK registered office & director address

- UK bank account referral

- Apostille & legalisation for documents

- Accounting, VAT & tax filing

Legal Compliance for Overseas Directors

Under UK law, non-residents can fully own and direct a limited company. However, compliance with:

- UK Anti-Money Laundering Regulations

- Companies Act 2006

- Annual filings to HMRC and Companies House

is essential. We help ensure you're 100% compliant.

FAQs

Yes. There are no residency restrictions for UK company directors or shareholders.

No. You can register a company online through CG Incorporations without visiting the UK.

Yes, through digital banking partners and EMI solutions referred by CG Incorporations.

Often yes—especially due to lower setup costs, no capital requirements, and fewer legal translations.

UK corporation tax is 25% as of 2025. CG Incorporations provides expert tax compliance services.

Conclusion: Why the UK Remains the Preferred Choice

The UK remains a globally trusted destination for non-residents forming companies. With fast registration, low barriers, and strong legal support, it's the jurisdiction of choice for international founders.

Start your UK company with CG Incorporations today.

Sources: UK Government (gov.uk), European Commission, OECD Tax Database 2025

Published: 8/4/2025 7:00:27 AM. Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

For formal advice regarding UK company registration please…