Introduction

The United Kingdom has long been a preferred destination for global entrepreneurs. With Brexit introducing regulatory shifts, many non-residents have asked: Is the UK still a good place to start a company? The short answer is: yes.

This article provides a comprehensive, legally compliant, and data-backed analysis of how Brexit has influenced UK company formation for non-residents—and why the UK remains one of the most trusted, tax-efficient, and globally connected business environments.

Key Changes in UK Company Formation Post-Brexit

1. Loss of EU Establishment Rights

| Pre-Brexit (EU Membership) | Post-Brexit (2021 onwards) |

|---|---|

| EU citizens had automatic rights to establish businesses under EU law | EU citizens treated like any other non-resident |

| Cross-border services without additional paperwork | Import/export declarations now required |

| Mutual VAT recognition | Separate VAT registration and compliance required |

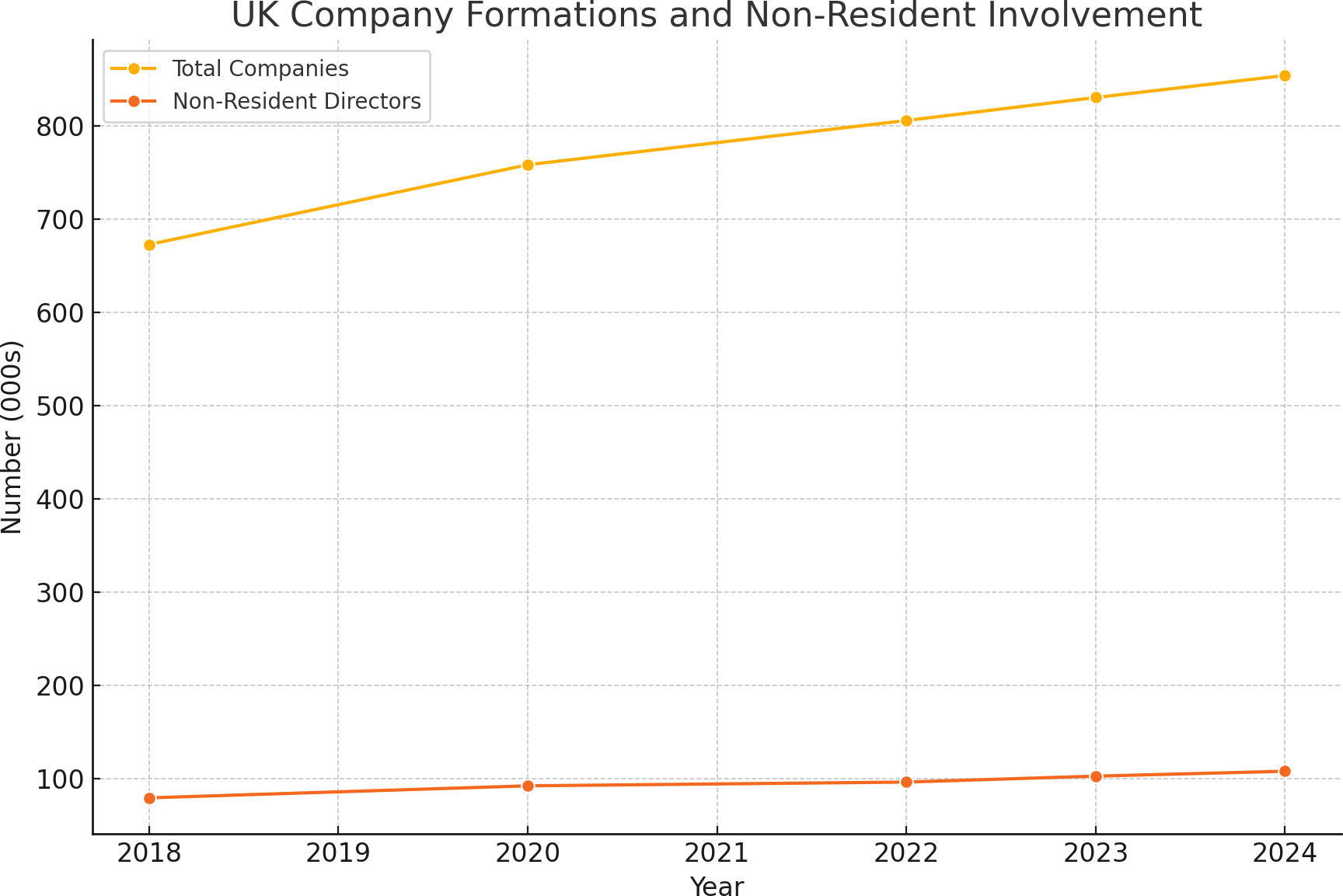

2. UK Company Formation Trends Remain Positive

| Year | Total New Companies | Non-Resident Directors Involved | % Involving Non-Residents |

|---|---|---|---|

| 2018 | 672,890 | 79,480 | 11.8% |

| 2020 | 758,370 | 92,360 | 12.2% |

| 2022 | 805,810 | 96,400 | 12.0% |

| 2023 | 830,494 | 102,750 | 12.3% |

| 2024* | 854,100 (est.) | 108,000 (est.) | 12.6% (est.) |

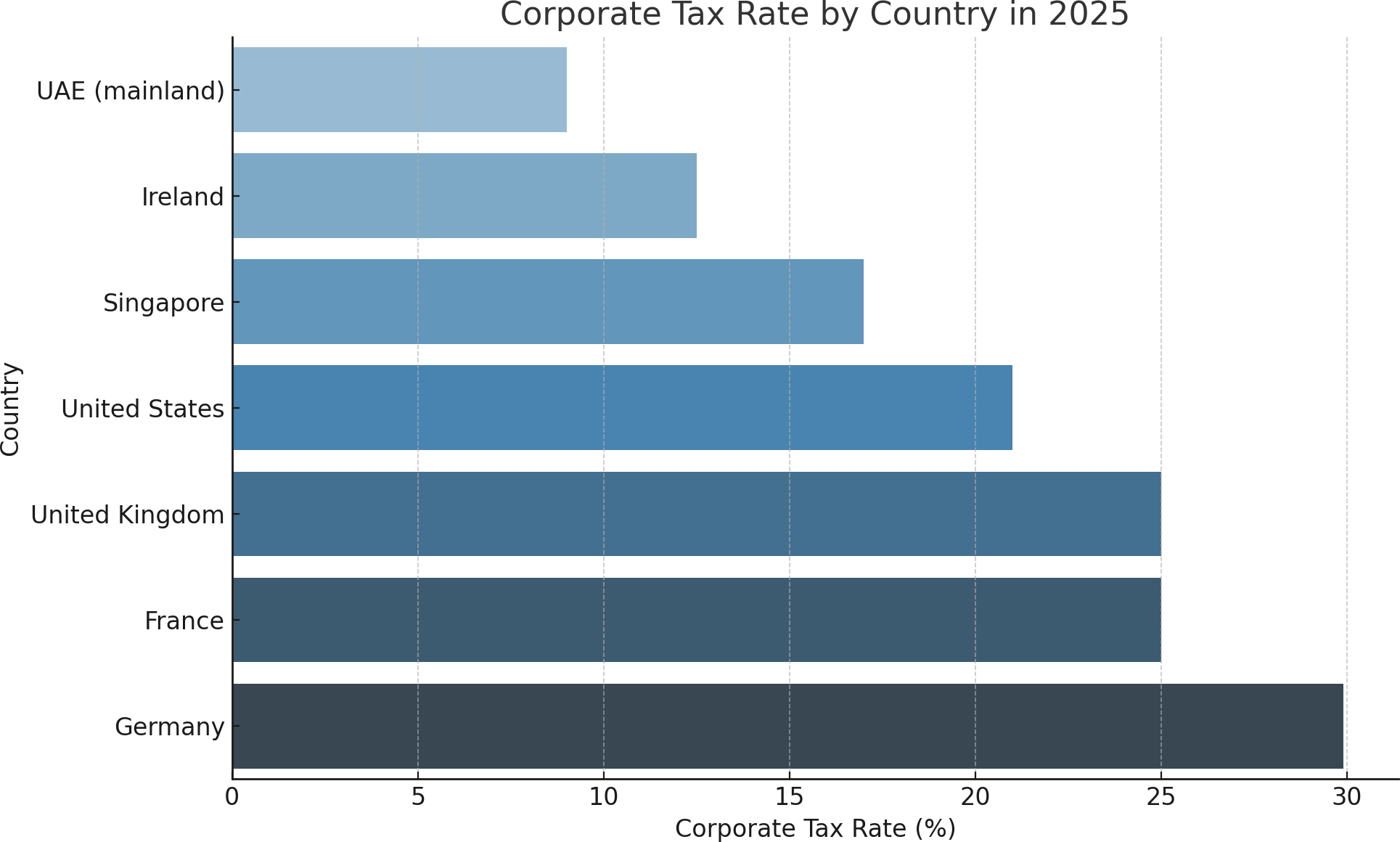

3. Corporate Tax: UK vs Other Business Hubs

| Country | Corporate Tax Rate (2025) |

|---|---|

| United Kingdom | 19% (profits ≤ £50k), 25% (> £250k) |

| Ireland | 12.5% |

| Germany | 29.9% |

| France | 25% |

| United States | 21% |

| UAE (mainland) | 9% |

| Singapore | 17% |

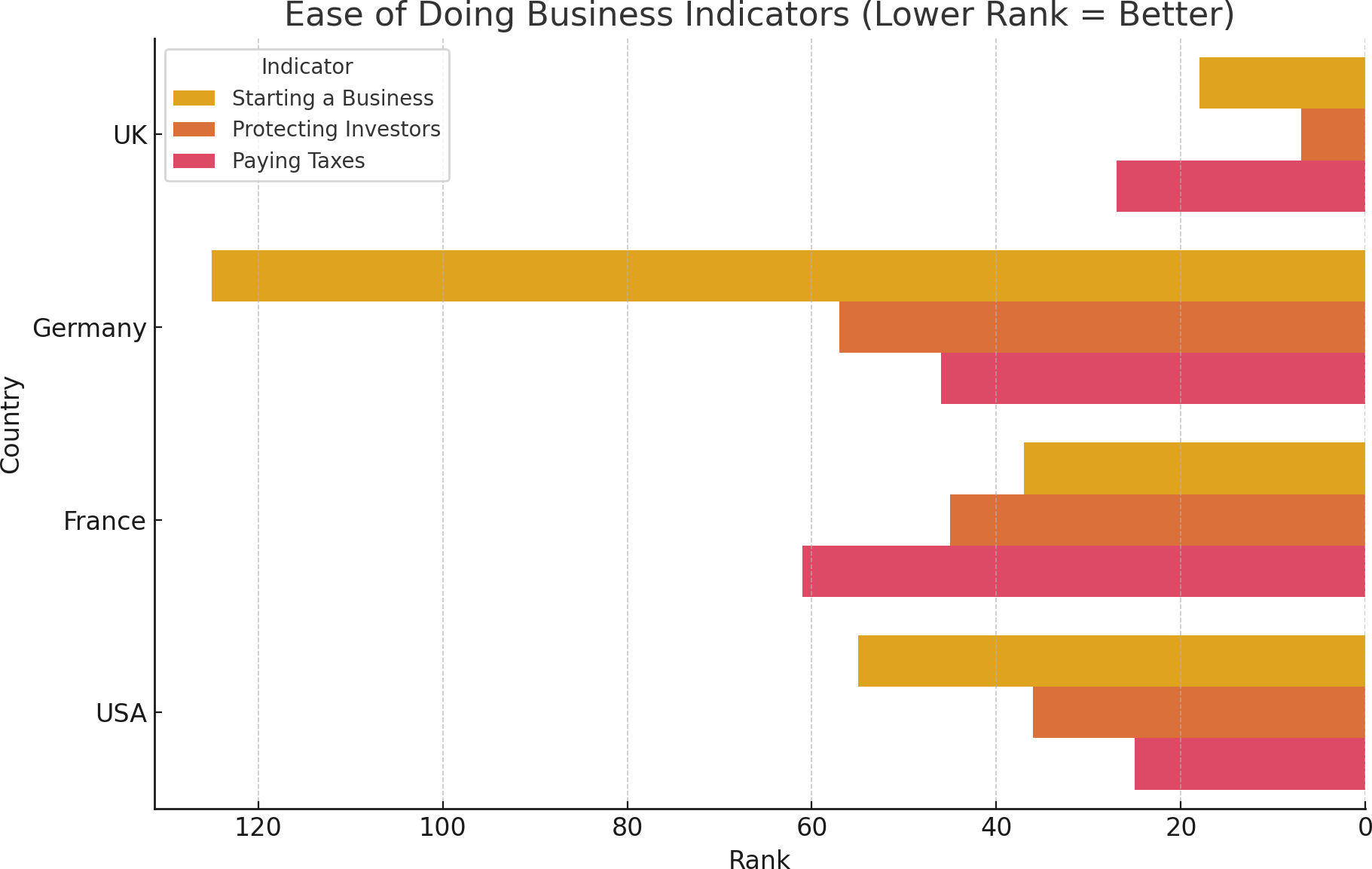

4. Ease of Doing Business Rankings (lower rank = better!)

| Indicator | UK | Germany | France | USA |

|---|---|---|---|---|

| Starting a Business | 18 | 125 | 37 | 55 |

| Protecting Minority Investors | 7 | 57 | 45 | 36 |

| Paying Taxes | 27 | 46 | 61 | 25 |

5. Top Industries for Non-Resident Companies

| Sector | % of Non-Resident Formations (2023) |

|---|---|

| eCommerce & Dropshipping | 28% |

| Consulting & Advisory | 21% |

| IT & Software Development | 14% |

| Real Estate Investment | 11% |

| Financial Services | 9% |

| Import/Export & Logistics | 7% |

| Education & Training | 5% |

| Other | 5% |

Verified UK Tax and Legal Information

| Tax | Rate / Threshold (2025) |

|---|---|

| Standard VAT | 20% |

| Reduced VAT | 5% |

| VAT registration threshold | £90,000 turnover |

| Corporation Tax (≤ £50,000) | 19% |

| Corporation Tax (> £250,000) | 25% |

| Marginal Relief | Applicable between £50k and £250k |

📊 Why the UK Still Stands Out for Non-Resident Founders

Despite Brexit, the UK’s tax framework remains globally competitive:

- Simple, well-established tax structure: No sudden hikes; corporation tax capped at 25% through this parliament.

- VAT rules fully sovereign since the UK left the EU, but set at moderate levels comparable with peers (standard 20%, reduced 5%).

- High VAT threshold (most EU countries threshold lower), giving SMEs breathing room before mandatory registration.

FAQs: UK Company Formation After Brexit

- Passport or ID

- Proof of residential address

- Company name and business activity

- Registered office and service address in the UK (provided by CG Incorporations if needed)

Conclusion

Despite Brexit, the UK remains a world-class business destination. Competitive tax rates, legal transparency, and a robust framework make it an excellent jurisdiction for non-residents seeking to expand internationally.

Why the UK Remains a Top Choice for Non-Resident Entrepreneurs

Despite the procedural changes caused by Brexit, the UK remains a strategic and stable jurisdiction for international business. Here's why:

- ✅ Full foreign ownership allowed

- ✅ No UK residency required

- ✅ English legal system with global recognition

- ✅ Strong IP protection

- ✅ Efficient online registration in 1–2 business days

- ✅ Trusted reputation with banks, customers, and suppliers globally

📈 Learn more about our complete non-resident formation package.

Get Started Today with CG Incorporations

At CG Incorporations, we simplify the process of UK company formation for non-UK residents with:

- ✅ 24–48 Hour Company Registration

- ✅ UK Registered Office & Service Address

- ✅ Apostille & Document Legalisation

- ✅ VAT & Tax Registration

- ✅ Accounting & Annual Compliance

- ✅ Bank Account Assistance

👉 Explore our service: Form your UK company now with CG Incorporations

References

Published: 7/28/2025 12:00:32 PM. Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

For formal advice regarding UK company registration please…